HIP20 is the present-day monetary policy for Helium and utilizes tried and true crypto economic mechanisms: capped supply and halvings (github). Thrown into the mix are the concepts of Burn & Mint equilibrium and Net Emissions. Understanding the network outlook boils down to answering one simple question: are the total number of HNT growing or shrinking? Despite the clear language of HIP20 it’s still not easy to form an intuition for this question. “$1M/month of network usage means a price of $20” is a line popularized by JMF, but what does it mean? How does one arrive at this conclusion? Are there other surprising conclusions?

→ follow me on twitter @DeWiGoSite ←

This post is really just an explanation of key concepts I wished were around when I tried to digest HIP20, starting with some of the common phrases thrown about when discussing Helium economics.

DC Burn is the core function of the network, and what we’re all here trying to do. Less understood is that there are two types of DC burn functions and the accounting is different for each.

- Data transfer (not deflationary, up to a point)

- Non-data transfer (deflationary)

Since the value of a data transfer DC burn is paid to the hotspot routing traffic, by definition it does not deflate the total supply of HNT until the total DC transfer in a 30 minute period (epoch) exceeds the allocation codified in HIP20. Today, this amount sits at 35% of total HNT emission per epoch, or approximately 1712 * 35% ~ 600 HNT. Due to nascent network utilization, true consumption is less than a 1/10th of a single HNT per epoch, so the unused portion is generously given to PoC participants.

Non-data transfer DC burns are from actions such as HNT transaction fees, onboarding fees and location assert fees. Since nobody is the recipient of these fees, there is no connection with Burn & Mint, and they are by definition purely deflationary.

Burn and Mint is where the use of the network is derived from burning the native token to redeem what amounts to non-transferable airline miles. The Multicoin Capital post will do the explanation more justice than I ever can. To say B&M is “kicking in” is really just a situation where demand-side HNT burn (constant cost) exceeds supply-side hotspot reward allocation (fluctuating), and thus the total supply of HNT is under deflationary pressure. Equilibrium is once again reached when the native token appreciates in price.

Put another way, when B&M is “kicking in”, hotspots won’t actually get paid the nominal rate for data transfer ($0.50 per 5G gb, $0.00001 per LoRa packet), instead earning a scaled portion. It always costs the same to use the network, but data routers only earn up to parity with cost. People assume this data transfer rate is fixed forever, but high network demand paired with volatile sentiment on $HNT can result in data transfer earnings less than expected. Today, it’s a far-off scenario but if the network really catches on it will surely happen and possibly catch people off guard.

Halvings. Like bitcoin, the monetary equation for Helium changes on a regular basis. Helium emission rate will halve every two years, but actually goes through changes on a yearly basis when the ratio of reward allocation between PoC, data transfer and founder reward all change. However, until DC burn from data usage becomes a greater quantity of usage, yearly changes are not especially relevant. I expect further changes to this reward schedule as more HIPs get implemented which factor in new forms of Proof of Coverage.

Net Emission is relevant many years from now and is framed as ‘a mechanism to ensure network participants always get paid’. The value of Net Emissions is locked at 34.42 HNT per epoch, and will not go down during halving cycles. Another way to think about Net Emission is it establishes a non-deflationary network utilization floor, or, a forever-window of 1:1 payment for data transfer participants.

There is a future date at which Net Emission, 34.42 HNT per epoch, makes up the lion’s share of all HNT available. Today, Net Emission consists of only 2% of the bucket per epoch (34.42 / 1712 HNT), in 5 years it will be 8%, but in 10 years it will be much higher at 65% and eventually consist of close to 100% of all available awards.

Crypto moves fast – how many headline projects from 2017 are around today? Its an interesting economic mechanism and critical for the long term network utility, but not likely a factor in Helium’s near term survival.

Painting a picture

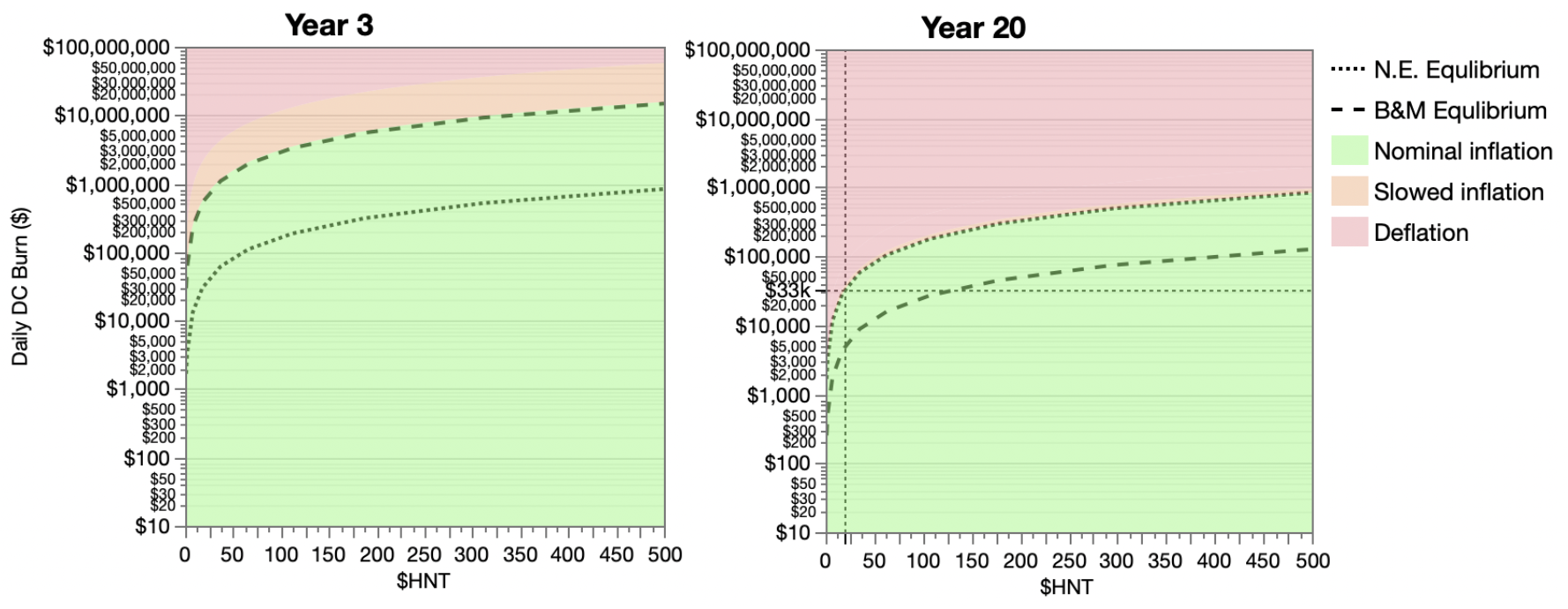

I present below the first true visualization of HIP20. Using two simple numbers – price of $HNT and daily DC burn, you can use the chart to determine if the maximum supply of Helium is increasing, decreasing, or staying the same. Because the economic model changes on a yearly basis, so must this graph, so the present-day 2021 3 Year graph is next to the 20 year steady-state chart.

Make note of the location of lines representing DC B&M Equilibrium and N.E. Equilibrium. They actually switch places in the year 20 chart because halvings decimate HNT total emission, allowing Net Emissions to become the steady state non-deflationary floor. Year 3 also contains a section I called Slowed Inflation, which amounts to contributions to total supply from PoC. By year 20 this inflationary buffer has disappeared entirely and the inflationary floor shrinks to meet the line of net emission.

This brings us back to JMF’s million-dollar comment: “$1M DC burn per month (33k per day), guarantees support at $20”. You can see this statement visually now by tracing the $20HNT dashed line and seeing it intersect with the $33k per day DC burn price. This relationship is linear, meaning $2M/mo burn equates to $40 equilibrium, $10M/mo burn to $200 equilibrium and so on.

A less sexy but more accurate statement would be “In Helium’s steady state economic environment 17 years from now, DC burn in excess of $1M per month causes deflationary pressure on total supply when the token is priced below $20”.

(But that’s not as good of a tweet.)

I must point out this pertains to Data DC Burn only. The network burns on the order of $200k worth of onboarding fees daily, which is indeed deflationary. You can use the non-data DC burns alongside these charts, but the colors and boundaries will lose meaning.

The Helium economics are a simple but cleverly designed, utilizing well understood and accepted ideas within the crypto world along with a few new ones. The long term viability of the project requires the existence of a healthy stream of demand-side HNT burn. We are NGMI as long as HNT demand is driven by circular onboard and transaction fees. Stay tuned for a future article where I will discuss those exact prospects as it pertains to 5G.