Blockchain is breaking into entrenched industries. ExxonMobil now mines bitcoin. Goldman has a crypto desk. At par with banking and natural resources lies Telecom, an industry characterized by government sanctioned monopolies, regulatory capture, awful consumer experience and consolidative economies of scale. Decentralized wireless, consisting of Helium, Pollen and a growing list of others, is blockchain’s grand entrance into Telecom.

It’s easy to be overzealous and suggest DeWi will push out the TradWi incumbents. However, just as bitcoin’s digital energy narrative doesn’t displace the need for electrons, and permissionless collateralized loans doesn’t eliminate the need for traditional mortgages, so too does decentralized wireless not replace the need for macro cell towers and fiber optic trenches.

This essay is a sober look at how decentralized wireless networks scale and might eventually fit into our lives. I’ll be focusing on the recently emerging cellular CBRS variety.

Decentralization is leverage

Today’s CBRS DeWi doesn’t even begin to satisfy the needs of a modern mobile experience. How can it possibly (1) get scale, and (2) attract users? Broadly speaking, early blockchain applications have an awful user experience and there is no shortage of friction in CBRS DeWi networks. As projects like Helium and Pollen begin to ship early CBRS products, sky high expectations are crashing back to earth: these networks have low transmit power, no voice or e-911, no existing coverage, limited bandwidth, wide range of deployment skill, downtime, low or no roaming capability, and spectrum sharing overhead.DeWi networks actually have much more in common with decentralized finance (DeFi) systems beyond first glance, especially when it comes to learning curve and friction. To collateralize your first DeFi loan, you must grasp public key / private key cryptography, gas fees, wallet management and all the new jargon. Cheapshots are easy, reminiscent of the Letterman / Gates bit. There’s a learning curve. It’s painful. What sets these DeFi systems apart from TradFi, and thus gives DeFi protocols value, are special decentralized qualities of composability and neutrality. These effects can transform casual participants into a type of permissionless protocol employee, working behind the scenes to grow the underlying project, or enable features to combine across different protocols like legos. Uniswap is a good example of this effect taken to its logical conclusion – Uniswap Labs, a company with a grand total of ~50 traditional W2 employees, has birthed a protocol which recently facilitated over $1T in volume to date. DeFi token distribution mechanisms called yield farming (or liquidity mining) have been the key to immediate scale for dozens of other DeFi protocols, with unique yield farming strategies permissionlessly mixed and combined. Some new and interesting ideas have been born out of this, some not so useful ponzis have crashed to zero. Love it or hate it, composability and neutrality is a 21st century form of leverage and this applies to both DeFi and DeWi.

Proof of Coverage = Yield Farming

Why build and use an early DeWi CBRS network? Why download an eSIM, why seek out spotty connectivity, why purchase and setup a node? The answer is almost too obvious. DeWi networks give you crypto! The first, and most important use case for DeWi networks is to farm crypto. Proof of Coverage is just yield farming by another name. Proof of Coverage has different economies of scale compared with DeFi yield farming, but PoC is yield farming nonetheless

Any DeWi project that puts roadblocks in the way of man’s insatiable desire to yield farm, even if done for the sole reason of emphasizing long-term sustainable protocol revenues, is doomed to lackluster adoption. 👏 People 👏 just 👏 want 👏 crypto 👏 — and I’m happy to see this fact recognized in Helium’s latest protocol improvement proposals HIP51-53. Flatly rejected are the notions that Helium 5G doesn’t need PoC to work, instead to be replaced by airdropping $MOBILE to participants who merely plug in approved CBRS radios. Plug in, get paid. This alone is all which is needed to keep Helium growing in a competitive CBRS DeWi landscape.

So, we’ve established that DeWi networks get big through the distribution of tokens, with numerous precedents. PoC is basically a bet on human nature and size is an important ingredient for utility. Let’s talk about the path to real usage.

Wen Utility?

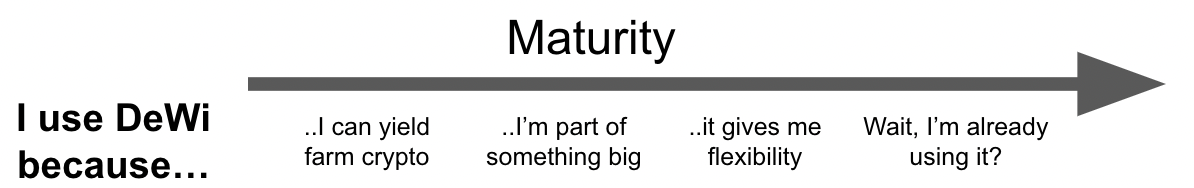

Yield farming is not the be-all end-all. I view DeWi networks at the sweet spot intersection of speculation and utility, because at a certain scale DeWi networks transform from speculative instrument to a network with obvious normie utility. As the DeWi project (and coverage) grows, so do the reasons for building and consuming.

Beyond the initial crypto fascination, becoming involved in DeWi evolves into a mission or even a competition. Now you are building with a purpose. Now, you are empowered to cover your friends and family or fix coverage gaps in parts of your life that annoy you – like that mountainous gas station where you rendezvous with your ski buddies, but nobody has cell phone service.

Before you know it, urban residents may find that they have DeWi reception more often than not, and so we enter the phase of flexibility. Maybe you can finally opt for the lower tier MNO data plan now that you’ve got a source of cheap pay-as-you-go data. You can have the flexibility to work somewhere lacking free wifi and not decimate your data plan. Or, you can outfit your kids with old cell phones without spending an afternoon at the AT&T store dealing with upsell tactics and dark patterns.

The maturity chart looks linear, but in reality each step is 10x harder to accomplish. In the final stages of maturity, you’re already using the DeWi network and you don’t even realize it. Such use cases might be because your MNO/MVNO plan roams onto a DeWi node, or some new standalone wireless device comes bundled with a lifetime supply of prepaid data. Perhaps you have a device built on top of these new networks, like DIMO or Hivemapper.

You’ll note I never once declare that people will drop their existing MNO plans all together. From where I stand, there’s just too much missing – mainly continuous coverage, phone numbers and customer support. However, this is far from an admission that these DeWi networks have no use.

Utility Soon™

Every credible blockchain project has a word for mainstream adoption – that moment for when the obvious 100x boost to utility unlocked by blockchain finally convinces incumbents to go all in and bring sustained protocol revenue with them; in DeFi they call it the DeFi Mullet, because FinTech firms of all shapes and sizes will use a DeFi backend for their normie client frontend needs. For Bitcoin its the digital gold narrative. In DeWi this moment is “Neutral Host”, aka the moment you rely on the network without realizing it. The Bitcoin digital gold narrative is arguably in progress, but the DeFi mullet is still in its early days and Neutral Host is just a twinkle in our collective eye. If anything, this is the everlasting criticism for blockchain in general. Too much supply, not enough demand. Too many tokens, not enough usage. I’m getting a little facetious in this final closing section, but the truth is I believe yield farming methods can be a tremendous tools for building tangible and useful physical infrastructure at an incredible pace.Until that moment in time when blockchains carry us to the golden gates of Valhall sustainable protocol revenue, at least we’ll be farming crypto.